That's not to say you shouldn't do it. Be prepared to do a lot of cleaning, and possibly some reovations.

What Makes Buying A Foreclosed Property Risky Millionacres

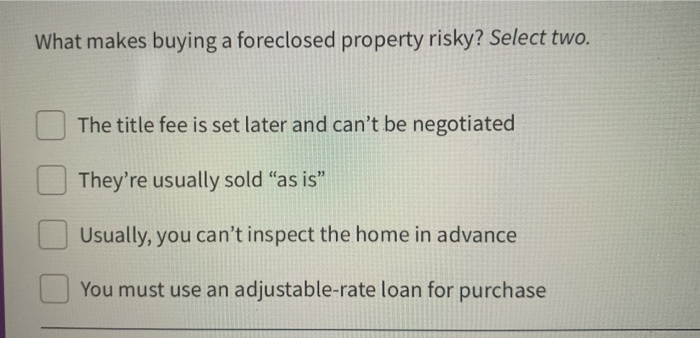

The title fees are set later and cant be negotiable b.

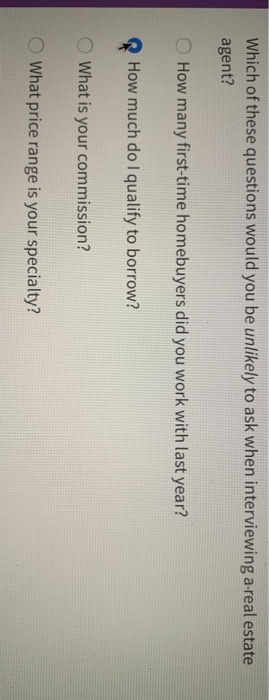

What makes buying a foreclosed property risky select two. framework. What price range is your specialty? When a property has been foreclosed, it means the bank has repossessed the home from the homeowner, who stopped paying the mortgage loan. And sometimes angry home owners purposely damage the property to punish the foreclosing lender.

You need airflow to discourage mold from growing. Buying a foreclosed property offers you a good opportunity to snap up a below market value real estate investment. Both the down payment and the monthly expenditure will be lower than traditional loans.

The most common mistake people make when they buy a foreclosure known as a distressed property is thinking that the price is the price. One of the most immediate advantages is the low cost at which foreclosed properties are often offered. There are certain risks while buying a foreclosed property.

What makes buying a foreclosed property risky? So if the home is sitting vacant for years, there is a big possibility there is mold in the home. You may get a money pit and not know it until its too late.

When a home is foreclosed on, the bank normally turns off the power and this can become a problem. A quantitative risk model (fico) components: This is ultimately what makes buying from a foreclosure sale so risky.

The first and major risk in buying a foreclosed property is damaged property. The cost of repairs can far outweigh the savings. Buying a foreclosure gives you access to more affordable financing.

Some of the rewards of buying a foreclosed home include: It is possible to find deals. (1) if you make a down payment of $25,000, you can obtain a loan with a 6% rate of interest or (2) if you make a down payment of $50,000, you.

Usually, you can't inspect the home in advance d. Some of them are as mentioned below: The cost of repairs can easily turn your bargain into a money pit.

If you buy the home from the bank with a real estate agent, you may have an inspection, but dont expect the bank to make any concessions if the property is in bad shape. Buying a foreclosed home certainly has its benefits. While some foreclosed homes require a lot of extra money to fix up, others can be purchased for below market value.

The title fee is set later and can't. Asked by maham237 @ 27/05/2021 in business viewed by 71 people. But if you do want to dabble in buying foreclosures, it's good business practice to first understand what makes buying a foreclosed property risky.

Foreclosed homes may seem like incredible investment opportunities, as they often sell for well under market value and many can quickly be readied for use as a home or a rental property. What makes buying a foreclosed property risky? They are usually sold as is c.

37xx series and vx series terminals wamework onlin. level of delinquencies and time since last delinquency (late payments, collection accounts, charge offs) revolving balances to credit limits (50%, anything over is bad) bankruptcy foreclosure (worse than a bankruptcy) deed in lieu (deeded the property to someone else but stayed in it) Many foreclosure auction properties are in bad shape because the owners couldn't afford the upkeep.

What is it exactly that makes buying a foreclosed property risky? A house is for sale for $250,000. Just be sure to do your due diligence and analyze the potential cap rate and return on investment.

You can't get inside the property before the auction to inspect it for structural problems and repairs. If you buy a foreclosed home in the right stage of its foreclosure cycle, there really is minimal risk thanks to things like title insurance which can protect you from hidden positions or unknown liens. Risks of buying homes in foreclosure.

What makes buying a foreclosed property risky select two framework. Here are some of the benefits of investing in foreclosure homes: Despite their appeal, though, foreclosed homes could come with an array of expensive problems and potential dangers.

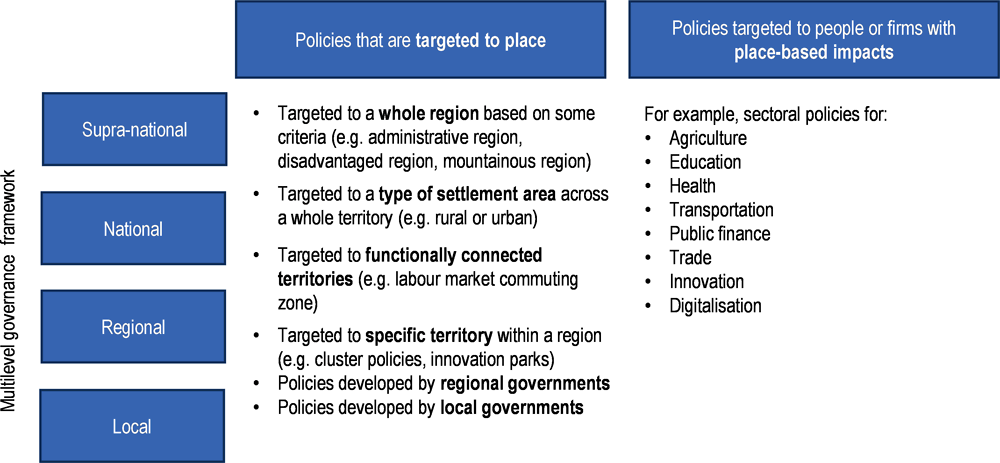

Policies And Strategies For Place-based Development And Inclusive Growth Regional Policy For Greece Post-2020 Oecd Ilibrary

Spain In Imf Staff Country Reports Volume 2017 Issue 345 2017

Solved 37xx Series And Vx Series Terminals Wamework Onlin E Cheggcom

What Makes Buying A Foreclosed Property Risky Mashvisor

Openknowledgeworldbankorg

What Makes Buying A Foreclosed Property Risky - New Silver

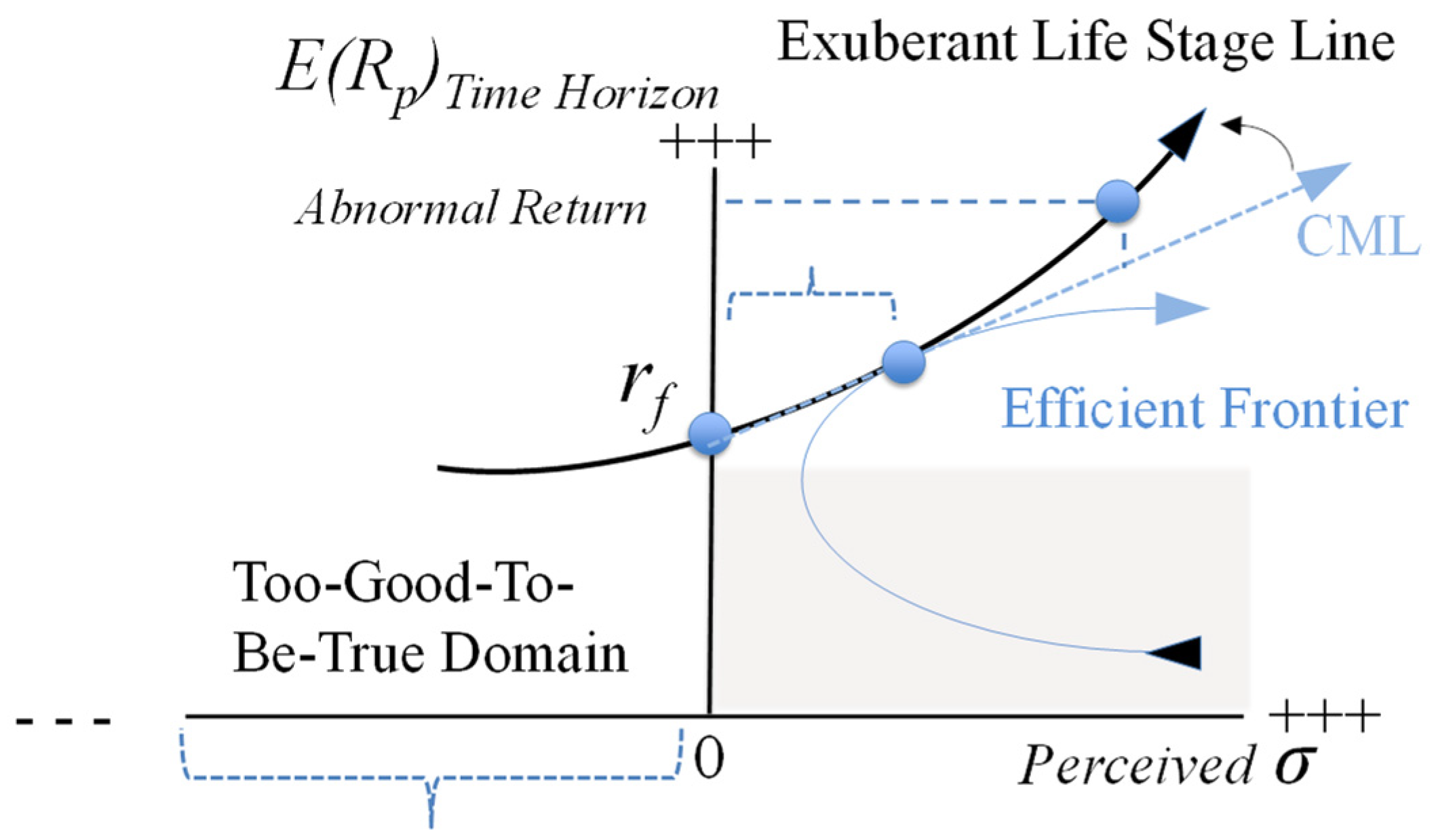

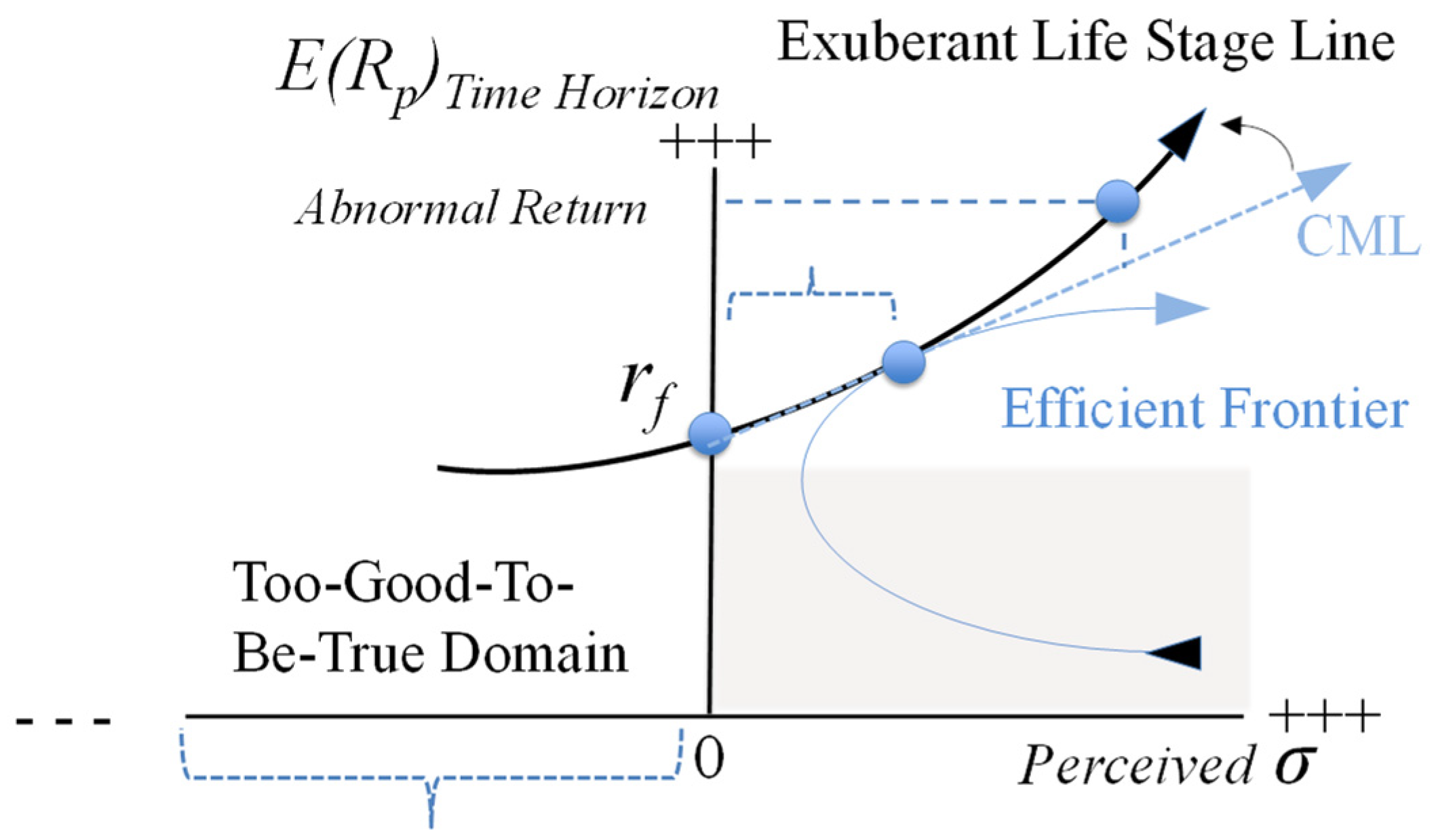

Ijfs Free Full-text Buy Now And Pay Dearly Later Unraveling Consumer Financial Spinning Html

What Makes Buying A Foreclosed Property Risky Millionacres

What Makes Buying A Foreclosed Property Risky Studycom

Solved Which Of These Questions Would You Be Unlikely To Ask Cheggcom

Elibraryimforg

Advantages And Disadvantages Of Buying A Foreclosure Hgtv

Pdf What Foreclosed Homes Should A Municipality Purchase To Stabilize Vulnerable Neighborhoods

Solved Which Of These Questions Would You Be Unlikely To Ask Cheggcom

What Makes Buying A Foreclosed Property Risky Select Two Chegg - Youtube

What Makes Buying A Foreclosed Property Risky Mashvisor

Idxcoid

What Makes Buying A Foreclosed Property Risky

Buying A House At Foreclosure Auction Is Risky Business

What Makes Buying A Foreclosed Property Risky Select Two. Framework. There are any What Makes Buying A Foreclosed Property Risky Select Two. Framework in here.